February 20, 2023

Each quarter, we share traveler insights based on Expedia Group first-party data and research to better understand traveler behavior to help our marketing partners reach and convert travelers. In the last report covering Q3 2022, we saw reassuring signs of enduring enthusiasm for travel despite growing economic headwinds, pointing to the resiliency of the travel industry.

As we begin 2023, we’re taking a closer look at how insights from the last quarter of 2022 may inform traveler behaviors in the year ahead. In Q4 2022, we saw an increase in search volume globally, signaling strong demand and sustained interest from travelers. Traveler confidence increased across the globe, as evidenced by lengthening search windows and earlier planning for 2023 travel. Read more about the key takeaways from our latest report, including the popularity of “flexcations” and the anticipated impacts of price sensitivity on travel planning.

Search volumes increasing YoY

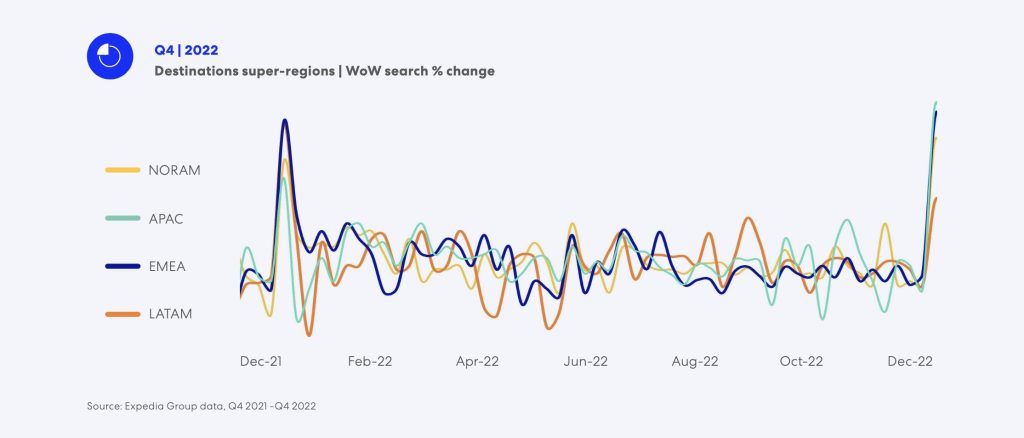

Traveler intent remains strong, as evidenced by Q4 2022 search volume data. Compared to the prior year, Q4 2022 global search volume on Expedia Group sites increased 10% year-over-year (YoY). Notably, Asia Pacific (APAC) search volumes were up more than 50% YoY, signaling positive responses to travel restrictions easing in various countries throughout the region, including China, Hong Kong, Japan, South Korea, Taiwan, and Thailand.

Globally, the week of October 3 saw strong week-over-week (WoW) search volume increases across domestic and international searches, corresponding with easing travel restrictions in destinations like Canada, South Korea, and Thailand. As we often see at the end of the calendar year, during the week of December 26, WoW search volume globally was up by 30%, signaling a return to seasonality.

Travelers plan ahead for 2023

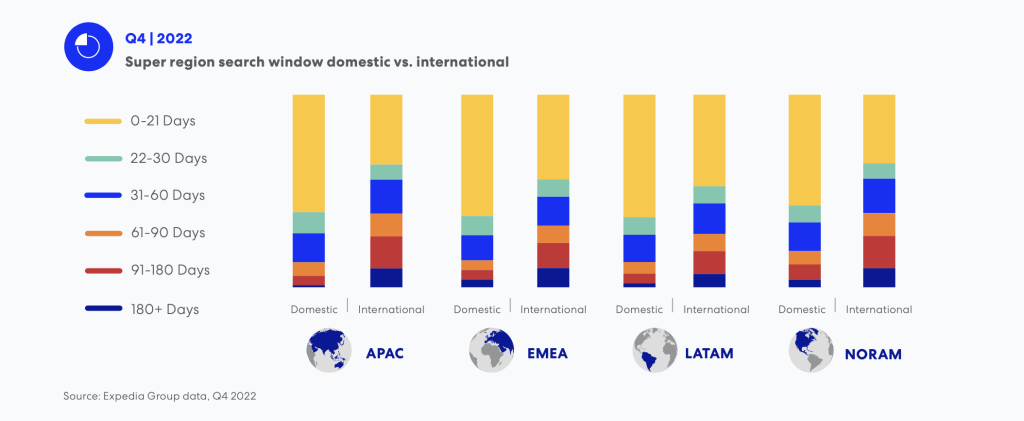

Even with most travelers still planning and searching for travel in the short-term, traveler confidence continues to grow, as evidenced by Q4 share growth for longer search windows. Globally, the 180+ day search window saw the strongest growth, with a 20% increase in search share quarter-over-quarter (QoQ) driven by QoQ growth in Europe, the Middle East, and Africa (EMEA).

Search share for the 61- to 90-day window was up nearly 15% globally, with double-digit growth in APAC and North America (NORAM). In Latin America (LATAM), travelers are still planning for the short term, with the strongest growth in the 0- to 60-day search windows, up 5% QoQ.

The shift to longer-term planning was also reflected in international search windows. Globally, the share of travelers searching for international destinations in the 61- to 90-day and 180+ day windows increased by 10% QoQ.

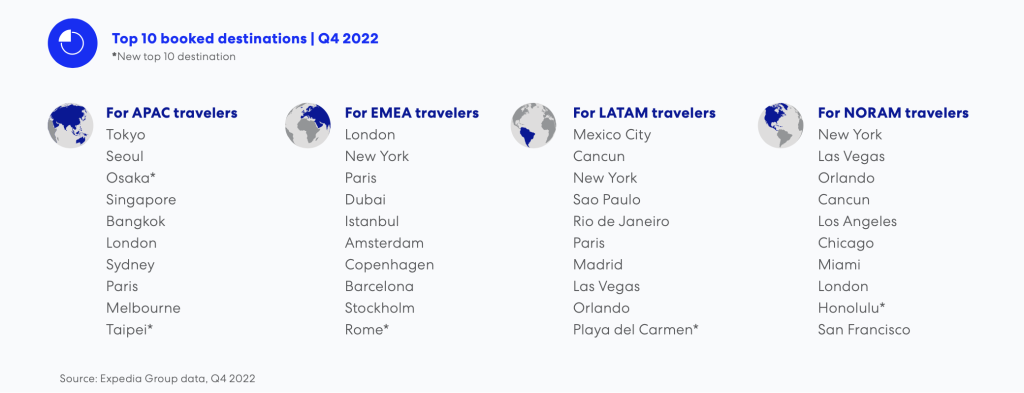

Beach and city destinations continue to shine

The popularity of beach and city destinations continued into Q4 2022, influenced by easing travel restrictions in APAC, holiday travel, and the appeal of warm weather destinations. The list of global top 10 destinations saw only minor changes from the previous quarter and the super regions of New York, Las Vegas, and London held on to the top spots, Tokyo was a newcomer to the list, Orlando and Cancun moved up in the rankings, and Miami overtook Boston for the No. 10 position. We saw similar destination trends in Q4 2021, as travelers in the Northern Hemisphere planned warm weather escapes during peak winter weather months.

While domestic travel continues to drive the vacation rental category, some new destinations outside of travelers’ home regions began appearing in Q4, including Paris for APAC travelers. With winter in full swing in the Northern Hemisphere, EMEA travelers turned to popular ski resort areas in France, while NORAM travelers opted for domestic warm weather getaways such as Naples and Cape Coral, Florida.

Flexcations becoming more popular

As flexible work options remain for many companies around the world, “blended” or “flexcation” travel – a longer stay that mixes remote work and play – is on the rise. Insights from our Traveler Value Index 2023 study back this up: 28% of consumers are looking to take a flexcation trip in the next 12 months.

This trend is also supported by Expedia Group flight data which shows that on average, travelers are taking longer trips YoY. This is particularly true for NORAM travelers, where the average length of stay in Q4 2022 was 10% longer than in Q4 2021.

Additionally, travelers have been using the “business-friendly” filter on Expedia.com and Hotels.com significantly more to find accommodations with amenities such as Wi-Fi and breakfast. In fact, our Q4 data shows a triple-digit increase in usage of this filter, further highlighting this growing trend and opportunities.

The return of price and value prioritization

In our last report, we observed the re-emergence of more price-sensitive travel shoppers amid growing economic headwinds, and this continued into Q4.

While overall intentions to travel are high, traveler spending behaviors are expected to evolve, pointing to the growing importance of price and value. According to the Travel Value Index 2023 study, low pricing is a leading factor when booking every element of a trip for nearly one out of every three travelers. This reinforces for travel brands the importance of demonstrating value, in pricing and through delivering exclusive offers, perks, and exceptional travel experiences.

Our research also shows that special discounted pricing is the top aspect of loyalty programs consumers value. In the current climate, loyalty may become more important to travelers, as they turn to loyalty programs to secure discounted prices.

These takeaways are only a small sample of the insights you’ll find in the full report, based on more than 70 petabytes of Expedia Group traveler intent and demand data. To learn more, download the latest Traveler Insights Report.