November 8, 2022

Since early in the pandemic, we have been analyzing and sharing the evolving behaviors of travelers as they return to travel. As pandemic fears wane and borders open, new sets of challenges have emerged, but travelers remain undeterred. As we shared in our last quarterly report, travel intent is on the rise and enthusiasm for travel has returned.

Based on Expedia Group’s first-party data from Q3 2022, we see that despite rising inflation, higher fuel prices, ongoing political conflicts, and natural disasters, consumers are committed to traveling and see it as more important now than pre-pandemic. And, they are planning further out, by shopping earlier than prior years for holiday travel, and for travel into the new year. Read on for the key takeaways from our latest Traveler Insights Report.

The Importance of Travel Underscores Sustained Enthusiasm

Travel today is more important to consumers now than ever before. In our latest Traveler Value Index 2023 study, 46% of consumers said that travel is more important to them now than it was pre-pandemic.

Q3 search volume data supports this, showing that traveler enthusiasm remains steady despite challenges. Following multiple strong quarters of search growth globally, in Q3 searches across Expedia Group branded sites were flat quarter-over-quarter. Asia Pacific (APAC), in particular, saw strong positive trends during Q3, with international search volume seeing 20% growth during several weeks, likely as a result of travel restrictions easing in Japan and Hong Kong.

Consumers are also looking to travel even more in the upcoming year, with 43% saying they are upping their travel budget and 79% saying they will take at least one leisure trip, according to findings in the Traveler Value Index.

Hotel advertising that can reach any traveler, anywhere

Travelers looking to book a hotel use multiple channels to find their ideal place to stay, from social media to travel websites, and more. This is why it’s imperative that you know when — and where — to reach the right traveler. Whether you’re trying to reach early-bird or last-minute bookers, our targeting capabilities can help you connect with the right traveler at the right time.

Travelers Open to Planning Further Out

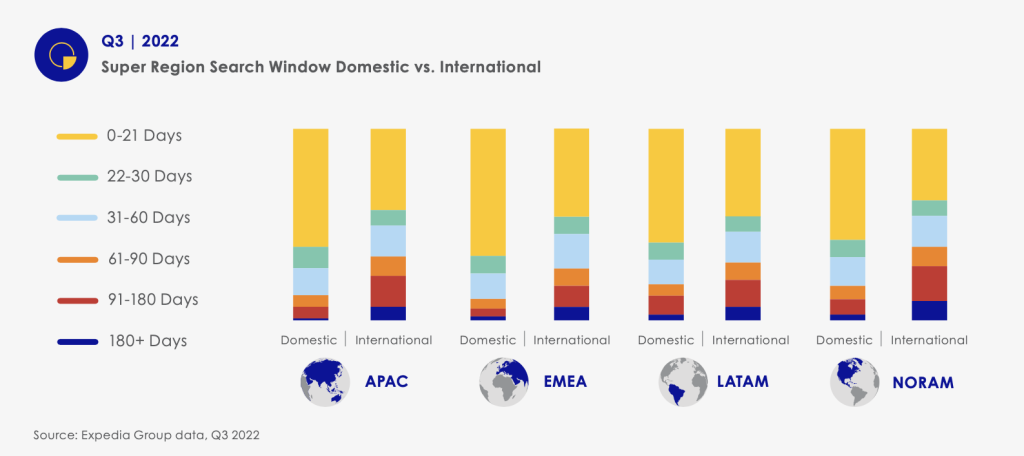

Most travelers are still planning trips in the near-term, with the largest increase in search window growth in the 0- to 21-day window. However, a historical look shows that searches in the 91- to –180-day window are up 10% since Q3 2019, indicating that travelers are planning their trips further out than even pre-pandemic.

Travelers from Europe, the Middle East and Africa (EMEA) and North America (NORAM) are looking at planning travel for next year, as evidenced by share growth in the 180+ day search window, which was up 25% quarter-over-quarter in EMEA and 20% in NORAM. In APAC, the strongest share growth occurred in the 91- to 180-day search window, up 10% quarter-over-quarter.

Travelers Plan for the Holidays & 2023

As travelers searched further out, many planned ahead for the upcoming holiday season. Globally, Q3 searches for travel during the holiday season (November-December) were up more than 60% year-over-year. This indicates that we may see an increase in holiday travelers this year, perhaps even more than seen in 2021.

With travel restrictions in APAC easing in recent months, pent-up demand for the 2022 holiday season is strong. Year-over-year searches for the holiday season during Q3 are up by triple-digits in the APAC region. EMEA also saw strong year-over-year growth of nearly 60%, while Latin America (LATAM) and NORAM were up by double-digits year-over-year.

Travelers also began planning their 2023 trips in Q3 with searches up nearly 65% year over year – a promising sign of continued enthusiasm for travel in the new year.

A strong target for holiday and 2023 travel could be families, as international family travel saw strong growth in Q3, increasing by nearly 90% year-over-year. As families are an important sector of travelers for many in the industry, this return signals an optimistic outlook.

City Breaks & Alternative Accommodations Grow in Popularity

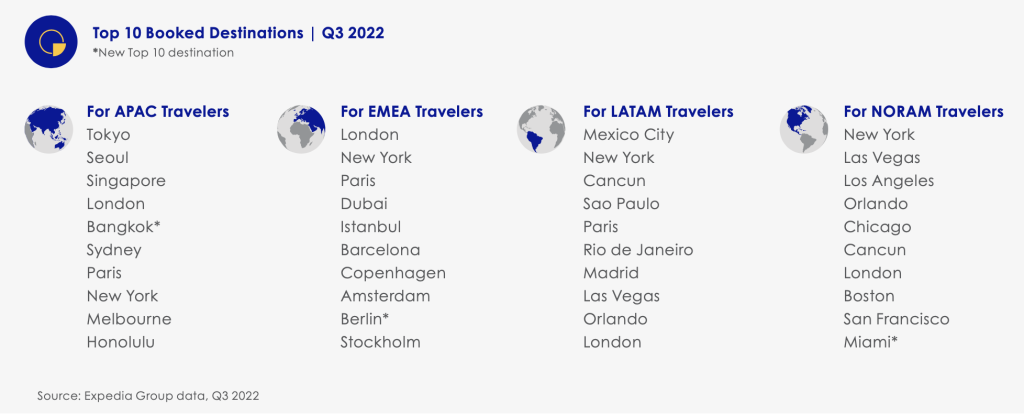

Similar to previous quarters, major cities and beach destinations made the global top 10 list of booked destinations in Q3 while city break destinations rose in popularity, including Chicago and newcomer to the list, Boston. New York and London made the top 10 list of booked destinations by travelers across all regions, while Paris again made the top 10 lists for travelers from APAC, EMEA, and LATAM.

The rising popularity of city break destinations also occurred on regional top 10 lists of booked destinations, including Amsterdam, Copenhagen, Istanbul, and a new addition, Berlin, in EMEA and Chicago and Boston, as well as newcomer Miami, in NORAM. In APAC, Bangkok entered the top 10, following the lifting of travel restrictions in Thailand on July 1.

In the vacation rental space, a new highlight this quarter was the rise of unique accommodations. Year-over-year demand for Vrbo alternative stays, defined as accommodations like cabins, chalets, chateaus, boats, recreational vehicles, etc., were up by triple-digits year-over-year, and up by over 50% compared to Q3 2019.

Business Travel is Making Gains

Workers are traveling for business once again, and optimism and excitement for the future of business travel is on the rise. Although business travel is not back to 2019 levels, Q3 showed a 10% increase in demand from travelers with a business profile across our sites, defined as a single adult traveler with an average length of stay of less than 4 days, starting their trip on a Monday-Wednesday.

Our Expedia Group research also revealed a rise in business travel intent for the upcoming year. Nearly 1 in 3 consumers (32%) plan to take a business trip in the next 12 months, including 65% of remote workers. Of those planning a business trip, 85% are looking forward to the trip.

Additionally, consumers are planning for both bleisure, where they extend a work trip with leisure, and flexcation trips, where they combine remote work with leisure. Among those taking business trips, 76% plan to take a bleisure trip. Blurring the lines between work and leisure, 28% of consumers plan to take a flexcation trip.

These takeaways are only a small sample of the insights you’ll find in the full report, based on more than 70 petabytes of Expedia Group traveler intent and demand data. To learn more, download the latest Traveler Insights Report.