February 15, 2022

We’re two years into the pandemic and still not out of the woods, but during that time we’ve seen resilience build in both our advertising partners and in travelers who have learned to adapt to the ever-present uncertainty. For travel marketers, evolving their activities in response to changing circumstances requires insights, which we have shared quarterly in our Travel Recovery Trend Reports for the past year. In our last report covering the third quarter of 2021, we saw sustained momentum for the industry as business travel picked up and travel shoppers made plans ahead of the holiday season.

Of course, recent events have reminded us that this uncertainty is here to stay, at least for a little while longer. Yet just as we saw several positive signs in Q3 despite the Delta variant’s impact on the industry, we also see evidence in the Q4 data that travel shoppers are continuing to make plans to satisfy their pent-up appetite for travel. Read on for a snapshot of the key findings in our latest installment—the Q4 Travel Recovery Trend Report—plus learn actionable insights to help your travel brand continue to rebuild and recover.

Better News for Asia Pacific

Given that in previous quarters the recovery in Asia Pacific (APAC) hasn’t always kept pace with that of the rest of the world, it’s encouraging to see that the market took significant strides at the end of 2021. In fact, APAC saw the most impressive quarter-on-quarter growth rate of any super region in Q4, with search volumes from APAC travelers up 35%. This was no doubt driven by the opening of safe travel lanes and the lifting in November of international travel restrictions for Australia.

Appetite for Travel Continues to Grow

On a global level, the last quarter of 2021 had its ups and downs, but evidence continues to build that travel shoppers are ready to see the world again. As Peter Kern, CEO of Expedia Group, said, “the travel industry and traveling public prove more resilient with each passing wave.”

Compared to Q3, overall global search volume in Q4 remained relatively flat. But when compared to the same period in 2020, global search volume was up 70%, while Europe, the Middle East, and Africa (EMEA) saw triple-digit growth year-over-year. This is a strong signal that travel shoppers feel decidedly more confident about making plans during this stage of the pandemic.

The travel industry and traveling public prove more resilient with each passing wave.

Peter Kern, CEO, Expedia Group

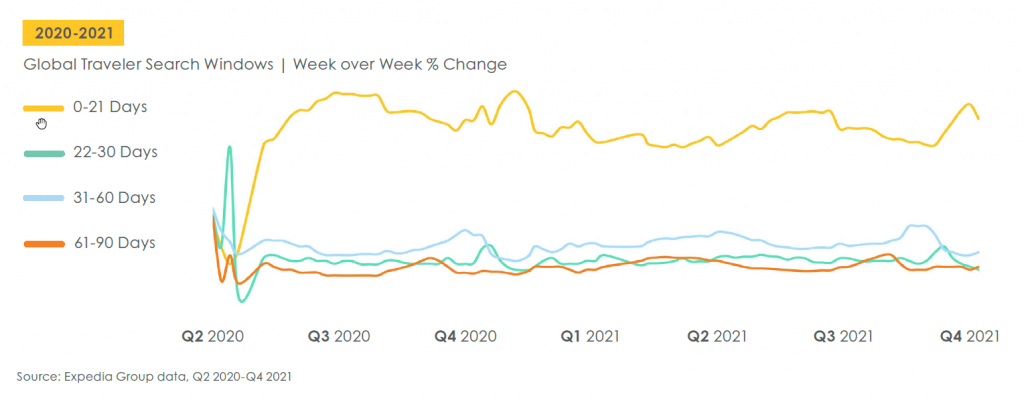

Travelers Searching Farther Out

The news that borders would reopen had a clear impact on search behavior, as did the upcoming winter holiday season. In our last report looking at Q3 data, we saw search windows shorten in most regions. But Q4 saw a shift back toward long-term travel planning with more travel shoppers looking for travel dates further out.

Global searches in the 31+ day window grew 15% over the previous quarter, taking share primarily from the shorter 0- to 30–day search window. Looking at the longer search windows, we saw the biggest jump in the 61- to 90–day timeframe, with a nearly 25% quarter-on-quarter increase.

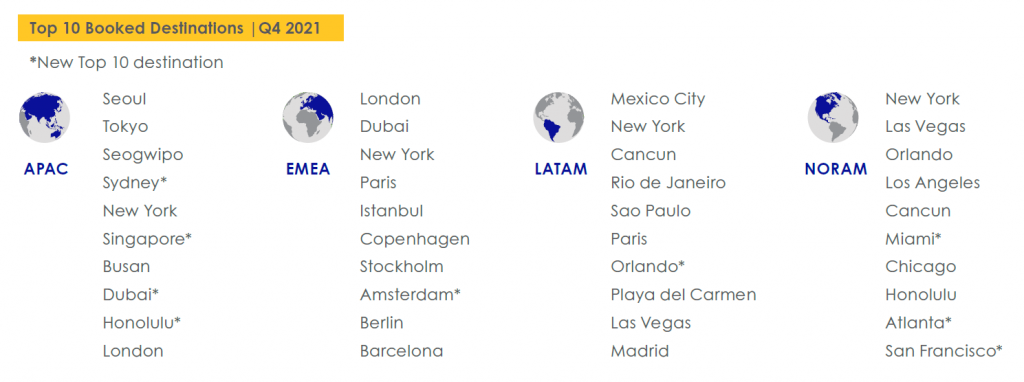

International Travel Increasingly Popular

As borders reopen, we’re seeing an increased demand for international travel. In our Q3 report, we saw lots of movement in the top 10 destinations booked between quarters, and this trend continues into Q4, both globally and within each region of the world. At the global level, New York was again a top 10 destination for travelers from all four regions.

Looking at each region’s top 10 booked destinations, we see a growing number of bookings made further away from home, indicating increased demand for international travel. Each region’s top 10 list includes cities located outside the region, but the regions with the biggest appetite to travel further were LATAM and APAC, which both included top destinations in two other regions. Latin American (LATAM) travelers were keen to visit both North America (NORAM) and EMEA, with five cities outside the region making the top 10: New York City, Las Vegas, Paris, Madrid, and Los Angeles. APAC followed with four cities, including two destinations new to the list: Dubai and Honolulu.

Vacation Rentals Maintain Popularity

Another positive trend we’re seeing pertains to lodging. In the fourth quarter, we saw both global lodging demand—including both hotels and vacation rentals—increase over 50% year-on-year. Looking at the global quarter-on-quarter data, we saw a notable shift in the share of bookings from hotels to vacation rentals – no doubt in part driven by family stays over the holiday travel season.

Similar to how we’ve seen travel shoppers search for travel farther out, we’ve also seen booking activity for vacation rentals occurring earlier than usual. Specifically, booking activity on Vrbo in 2021 occurred on average 2-3 months earlier than usual for several major travel seasons, including summer and the holidays. This behavior is expected to continue this year, as 60% of respondents in a recent Vrbo survey said they plan to book trips earlier than in previous years.

Hotel advertising that can reach any traveler, anywhere

Travelers looking to book a hotel use multiple channels to find their ideal place to stay, from social media to travel websites, and more. This is why it’s imperative that you know when — and where — to reach the right traveler. Whether you’re trying to reach early-bird or last-minute bookers, our targeting capabilities can help you connect with the right traveler at the right time.

These findings are just a taste of the insights you’ll find in the full report, based on 300 petabytes of Expedia Group traveler intent and demand data. To learn more, download the Q4 2021 Travel Recovery Trend Report. You can also reach out to us if you’re curious about data specific to your region or destination.